USDA, VA, FHA, and Conventional Loans Compared: Which Mortgage is Right for West Chester Buyers?

Buying a home in West Chester, PA is an exciting step — whether you’re looking at a historic townhome in the Borough, a suburban single-family in East Goshen, or new construction just outside of town. But choosing the right mortgage program is just as important as choosing the right house.

At CM Mortgage Services, Inc., we’ve helped hundreds of Chester County families find the right loan program for their needs. As a trusted local loan officer in West Chester, J.R. Conway (NMLS #147631) has built a reputation for making the mortgage process simple, transparent, and stress-free.

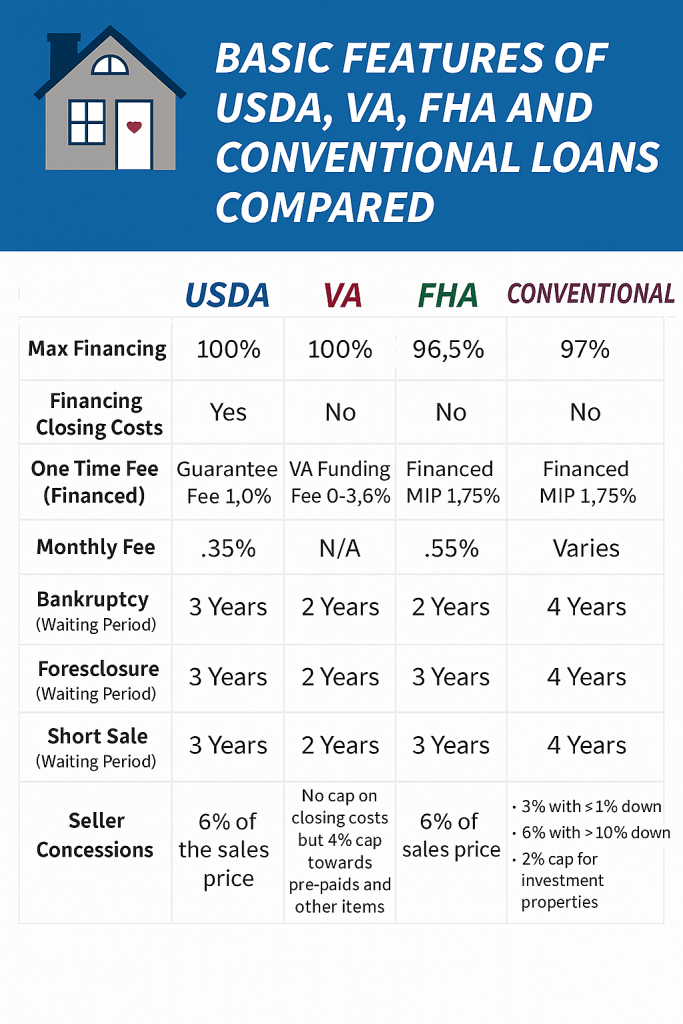

Here’s a side-by-side look at USDA, VA, FHA, and Conventional loans — and how CM Mortgage Services can help you decide which one is right for you.

USDA Loans in West Chester

Best for: Buyers in suburban or rural Chester County

- Max Financing: 100% (no down payment required)

- Closing Costs: Can be financed

- One-Time Fee: 1% guarantee fee (financed into loan)

- Monthly Fee: 0.35% annual fee

- Bankruptcy/Foreclosure/Short Sale Waiting Period: 3 years

- Seller Concessions: Up to 6% of purchase price

USDA loans are especially popular just outside West Chester Borough, in areas of Chester County that qualify as “rural.” With no down payment, this program makes homeownership possible for families who may not have a large savings set aside.

At CM Mortgage Services, J.R. Conway specializes in helping families determine USDA eligibility and maximize affordability when purchasing outside the Borough.

VA Loans in West Chester

Best for: Veterans, active-duty service members, and eligible spouses.

- Max Financing: 100% (no down payment required)

- Closing Costs: Cannot be financed, but sellers can assist

- One-Time Fee: VA Funding Fee (0–3.6%)

- Monthly Fee: None

- Bankruptcy/Foreclosure/Short Sale Waiting Period: 2 years

- Seller Concessions: No cap on closing costs, but 4% cap on certain items

With West Chester’s proximity to Philadelphia, Wilmington, and Delaware Valley military bases, VA loans are a powerful benefit for local veterans. They offer no PMI, no down payment, and some of the most competitive terms available.

J.R. Conway is proud to serve West Chester’s veteran community, helping service members and their families take advantage of every VA loan benefit available.

FHA Loans in West Chester

Best for: First-time homebuyers or those with lower credit scores.

- Max Financing: 96.5% (minimum 3.5% down)

- Closing Costs: Cannot be financed

- One-Time Fee: Upfront MIP (1.75%, financed)

- Monthly Fee: 0.55% annual MIP

- Bankruptcy/Foreclosure/Short Sale Waiting Period: 2–3 years

- Seller Concessions: Up to 6% of purchase price

FHA loans are especially popular with first-time buyers in West Chester Borough and surrounding neighborhoods, where home prices are often more affordable than in other Chester County communities. The flexible credit standards make FHA a great entry point into homeownership.

At CM Mortgage Services, J.R. Conway works with many first-time buyers in West Chester, guiding them through FHA approval and ensuring they get the best possible terms.

Conventional Loans in West Chester

Best for: Buyers with strong credit and higher down payment savings.

- Max Financing: 97% (as low as 3% down)

- Closing Costs: Cannot be financed

- One-Time Fee: Varies by loan terms

- Monthly Fee: PMI (varies; drops off at 20% equity)

- Bankruptcy/Foreclosure/Short Sale Waiting Period: 4–7 years

- Seller Concessions:

- 3% (with <10% down)

- 6% (with ≥10% down)

- 2% (investment properties)

Conventional loans are ideal for West Chester buyers purchasing higher-priced homes, new construction, or investment properties. Since PMI can eventually be removed, they offer long-term cost savings for borrowers with strong credit.

J.R. Conway regularly helps West Chester buyers weigh the benefits of Conventional loans, especially those purchasing higher-value properties in Chester County.

Why Work with CM Mortgage Services in West Chester?

- Local Expertise: We know the West Chester real estate market inside and out — from Borough townhomes to suburban subdivisions.

- Personalized Service: As a local loan officer, J.R. Conway provides direct, one-on-one guidance that national lenders can’t match.

- Fast, Reliable Closings: We pride ourselves on smooth transactions — helping clients close quickly and confidently, even in competitive markets.

At CM Mortgage Services, Inc., our mission is to help West Chester families find the loan program that works best for their needs — and guide them every step of the way.